take home pay

Thats because your employer withholds taxes from each paycheck lowering your overall pay. Secara sederhana Anda dapat mengatakan kalau THP merupakan.

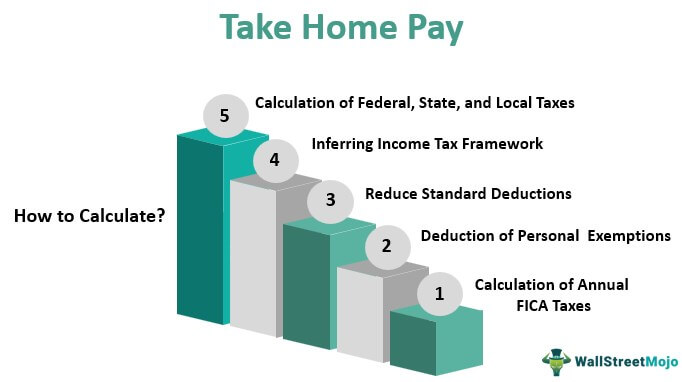

Take Home Pay Definition Example How To Calculate

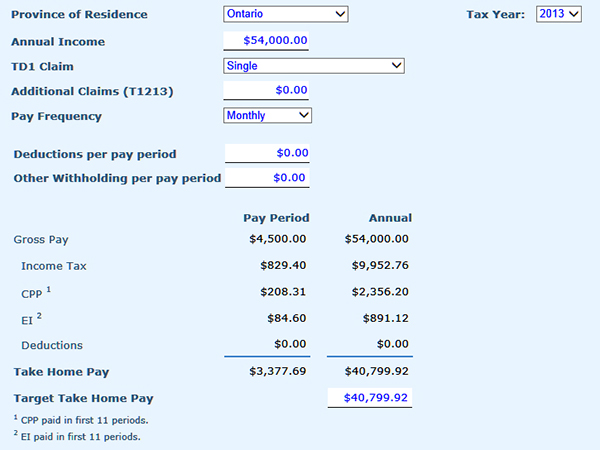

Employers may deduct Canada Pension PlanQuebec Pension Plan CPPQPP contributions Employment Insurance EI and Provincial Parental Insurance PlanQuebec Parental Insurance Plan PPIPQPIP premiums from an employees paycheck.

. New Zealands Best PAYE Calculator. Calculate your tax year 2022 take home pay after federalstatelocal taxes deductions and exemptions. Calculate your take-home pay given income tax rates national insurance tax-free personal allowances pensions contributions and more.

This action comedy focusses on Samoan brothers Popo Ronnie Taulafo and Alama Vito Vito who ditch the taro fields of home for the promise of big money picking kiwifruit in Aotearoa. Calculate your take home pay from hourly wage or salary. This tells you your take-home pay if you do not have.

The calculation is based on the 2021 tax brackets and the new W-4 which in. SEEKs new pay calculator helps you easily work out your take home pay depending on the salary youre offered for a role. Take-home pay in Canada is calculated by taking your pre-tax salary and subtracting federal and provincial taxes.

It can also be used to help fill steps 3 and 4 of a W-4 form. Your gross income is the amount of money you earn before any deductions like tax are taken out. Get a free quote.

Simply select the appropriate tax year you wish to include from the Pay Calculator menu when entering in your income details. Because of the numerous taxes withheld and the differing rates it. It is less than gross income because of the various amounts taken out from deductions.

Hourly rates weekly pay and bonuses are also catered for. Take-home pay can differ significantly from the gross pay rate. Switch to federal hourly calculator.

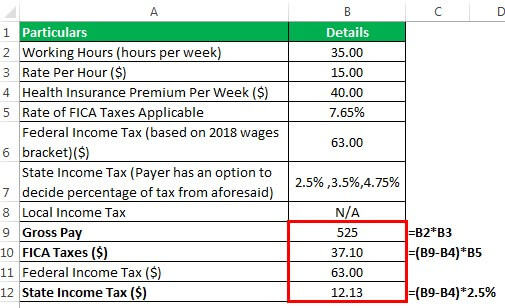

Why not find your dream salary too. This calculator is always up to date and conforms to official Australian Tax Office rates and formulas. As an example an hourly-waged employee making 15hour and working 80 hours per pay period has a gross pay of 1200 15 x 80 1200.

This calculator is intended for use by US. Calculating paychecks and need some help. Superannuation Study Training Loan Medicare PAYG.

KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE. How much youre actually taxed depends. THP berbeda dengan gaji pokok pendapatan rutin dan pendapatan insidentil.

Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2021 to 5 April 2022. Personal Income Tax Calculator - 2020 Select Province. Use this calculator to find exactly what you take home from any salary you provide.

Take home pay atau THP merupakan pembayaran utuh yang diterima karyawan suatu perusahaan dengan penghitungan penambahan pendapatan rutin dan pendapatan insidentil dikurangi dengan komponen potongan gaji. We have redesigned this tool to be as easy to use as possible whilst maintaining the level of accuracy you expect from our selection of tax tools. Take-home pay is the net income amount paid to employees after voluntary contributions benefits and taxes have been deducted.

For annual and hourly wages. Your take-home pay is the difference between your gross pay and what you get paid after taxes are taken out. Noun income remaining from salary or wages after deductions as for income-tax withholding.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. The latest budget information from April 2021 is used to show you exactly what you need to know. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees.

Three Wise Cousins and Hibiscus and Ruthless both proved popular with audiences and critics. Calculate your take home pay from hourly wage or salary. Australias Best PAYG Calculator.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The tool also takes into account relevant taxes and superannuation.

This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and. Use this calculator to quickly estimate how much tax you will need to pay on your income.

Take Home Pay - Take Home Pay marks the third self-funded feature for writerdirector SQS. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. UK Take Home Pay Calculator.

The Money Pay Calculator can be used to calculate taxable income and income tax for previous tax years currently from the 2015-2016 tax year to the most recent tax year 2020-2021. Looking for managed Payroll and benefits for your business. Salary Paycheck and Payroll Calculator.

For more information see our salary paycheck calculator guide.

Take Home Pay Official Trailer Youtube

What You Can Do About Shrinking Take Home Pay Tlnt

Knowledge Bureau World Class Financial Education

Take Home Pay Definition Example How To Calculate

Here S How Much Money You Take Home From A 75 000 Salary

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

0 Response to "take home pay"

Post a Comment